ILLUSTRATIONS BY RYAN SNOOK

Whiskey Flipping Today

On bourbon’s secondary market, prices are down, protections are up, and buyers may finally have their moment

December 24, 2025 –––––– Sean Evans

The American whiskey secondary market isn’t often seen as a source of optimism. But on rare occasions, it surprises. Over the last year, the market has revealed a number of shocking truths. There are fewer scammers. Buyer protections are increasing. Shipping is far less problematic. More bottles are available. But the most eyebrow-raising development? Pricing is improving.

Our last deep dive into this market, in the Fall 2021 issue, detailed a marketplace reaching fever pitch, fueled by COVID stimulus checks, boredom, and lockdowns. Now? The bubble has burst and the market is cooling—though it’s still warmer than it was before the pandemic lit the fuse. Let’s unpack the reasons why the market has turned, what has drastically changed, and assess its future, which looks brighter for those more interested in sipping than flipping.

Pricing Downtrend

Across dozens of Facebook and Discord secondary market groups, trends show prices dropping substantially—particularly annual, allocated rare bottles (think anything made by Sazerac or Heaven Hill). Take Weller Full Proof. Two years ago, those bottles were $300; they now hover at around $150. Thomas H. Handy, which once commanded $650, now moves at $400. Pappy Van Winkle 23 year old dropped 30%, from $4,000 down to $2,800.

“The pricing correction is good for the average person who lives somewhere that never gets rare bottles,” says Kenny, who runs a large secondary group and asked for his last name to be withheld. “If they wanted to try Weller CYPB two years ago, it was $600. Now it’s $350, so they can realistically go for it.”

What’s causing the pricing slide? “More people selling,” says Prav Saraff, who can legally buy from the secondary market to resell through his retail store, 1 West Dupont Wines and Liquors in Washington, D.C. “There’s uncertainty in the economy, and people are rushing to sell. There’s so much inventory [on secondary], we can be very aggressive in buying prices.”

Other factors, including the current bourbon glut, have led distilleries to focus on fairer distribution, and others like Heaven Hill are adding everyday shelf extensions of allocated brands—the recently introduced Old Fitzgerald 7 year old bottled in bond, for example. “That means people who were using the secondary market as a source of income have to stop,” says Kenny. “The margins no longer make sense.” Using a rye as example, he cites Mitcher’s 10 year old. “That’s a $200 bottle at retail, and it’s $225 on secondary. Add in tax and shipping fees, and there’s no money to be made.”

Both Kenny and Saraff note unicorn bottles—King of Kentucky, Michter’s Celebration, and Rathskeller Rye, for example—are largely immune from price recalibrations. “The people who hunt and buy those have a ton of money,” Saraff says.

More Deals Done with Confidence

There are still dedicated Facebook groups run by overseas actors who conspire, posting sales of bottles they don’t own, vouching for one another, and even making fake offers. After a few people pay (via PayPal, CashApp, or Venmo), the page disappears, and the syndicate rapidly builds a new one. Specifically, beware of secondary groups titled “Blanton’s Dump Date” with a group number suffix.

Meanwhile, admins of established platforms are stepping up their game to keep scammers at bay. Facebook still has most of the secondary action, but more groups are migrating to Discord, where anonymity, vetting tools, and reputation scores offer more peace of mind (and less chaos). Still invite-only, any deal reported as complete by both the seller and buyer earns each party points that advance status. Any stranger’s reputation is visible at a glance, and it’s impossible to fake. Plus, Discord groups use bots to trace invites like family trees. One bad apple? The whole branch gets pruned. The message: Vouch for bulletproof pals only.

Major issues are fewer. Kenny says the community itself is “great at looking out for each other, now more than ever,” he says. “People reach out when members are manipulating the market [by colluding to drive up pricing]. If you mess up and won’t make it right, you’re out,” he says. It’s rare, but when it happens, he shares names with other group admins who follow suit, blacklisting that individual from the platform.

Shipping is Less Risky

Expectations about secure shipping have improved. Bombproof shipping used to mean wrapping a bottle with a mile of bubble wrap, then using a half-ton of packing peanuts. Now, wine mailers are standard, resulting in less breakage overall. The majority of secondary buyers I spoke with for this article said 99% of their purchases arrive in perfect condition.

Still, selling on the secondary means abiding by house rules, especially the cardinal one: If anything goes wrong in transit, it’s the shipper’s responsibility. Saraff, who buys 60 to 100 bottles a week, once shelled out $15,000 for an Appleton Estate 50 year old rum. It arrived with a busted top; the seller had botched the wrap job. “I sent him a video of the numbered bottle with the broken top and said I can’t sell this now,” says Saraff. “The guy fully refunded me and told me to keep half the bottle to drink and send the rest back to him. That’s over-the-top generous. I sent back his half with some of my store picks as a thank you.”

Lotteries Abound

One notable secondary market uptick: more lotteries. They’re called fireballs, where people buy tickets for a chance to win bottles like Russell’s Reserve 15 year old, Parker’s Heritage, Old Forester Birthday, Double Eagle Very Rare, or Van Winkle Family Reserve. Mixed lots are common too, mostly to justify higher buy-ins.

Tickets range from $5 to over $1,000, depending on the prize. But here’s the twist: Winners are often offered a buyback, usually 90% of the bottle’s value in cash. The seller keeps 10%, reruns the fireball, and the cycle begins again. More often than not, winners take the cash. Some bottles spin through two-dozen rounds.

In the past, similar Facebook randomizer lotteries were plagued with rigged winners, ghosted payers, and nonexistent bottles. But on Discord, lotto bots now handle payments, run the lottery (always via random.org), and do the math on messy multi-winner buybacks. Simple, clean, and easy.

Better, Not Perfect

Despite progress, trouble areas persist. Vintage dusties are booming; great for collectors and better for scammers with fraudulent refills. Claims of shilling—brands propping up valuations by buying or bidding up their own bottles—abound, especially around newer non-distiller producers bottling BuffTurkey whiskey (though few accusers offer proof ). Lastly, drop and proxy ship websites are nightmares for customers and admins alike.

Public-facing sites (names withheld for legal reasons) list rare bottles at double the secondary price—without holding any inventory. When a product sells, the site’s reps quietly source the bottle for cheaper on secondary than they have it listed, and have the seller send it directly to the website’s customer. Myriad problems exist: It skirts the three-tier system, leaves no recourse for damaged or missing bottles, and ropes in sellers who don’t realize they’re shipping to a third party. Admins hate it; Kenny prohibits it.

The interest in high-end bourbon, domestically and globally, isn’t slowing.

Even legal bulk buyers like Saraff draw ire from some sellers and admins for deflating prices and squeezing out flippers. “We (definitely) affect the market,” Saraff says. “I put out offers to buy a dozen bottles; the next day, those bottles are listing at my price. I make it go down just by saying no to anything higher than I want to pay. Most sellers can’t afford to wait, so they accept.”

The Future of Secondary

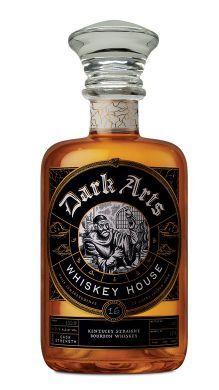

The interest in high-end bourbon, domestically and globally, isn’t slowing. So the secondary market is not shrinking. The American whiskey glut will lead to more limited-edition offerings, and more higher-end non-distiller producers’ bottlings hopping into the game. Labels and brands new to the secondary market are already leaping to the top of its price charts: New Era Whiskey and Spirits, Dark Arts Whiskey House, Bluegrass Distillers, and Augusta Distillery. Expect that to grow.

Factor in a potential economic recession, and the secondary market will, in the near term, continue to price-correct downward, and then stabilize. Unicorn bottles, as brag pieces, will always remain high. For everything else, those COVID price spikes are long gone.

More coveted bottles at lower prices? That’s excellent news for drinkers. “It’s less great for mid-tier collectors,” laughs Kenny. “Drink those bottles; don’t wait to sell later or trade. There’s very little you can buy these days that you’ll see having long-term value down the line. Just crack them and enjoy.”

The Hottest Bourbon Brands and Bottles

More than ever, the secondary market is full of delicious options. “I tell my clients nothing’s out of reach,” says Prav Saraff. “If you can dream it, I will use the secondary market and make it happen.” What’s the most in-demand?

BuffTurkey

This frankenbourbon, distilled by Buffalo Trace and aged at Wild Turkey, has age statements of 15-plus years. A variety of bottlers are using it, including Bluegrass Distillers, Dark Arts Whiskey House, and others. Choice bottlings go for more than $2,000 apiece.

Dusty Turkey

Any vintage Wild Turkey is in high demand, particularly cheesy gold foil bottles of 101, which move for three to four figures. Others, like the 13 year old Father and Son limited edition, fetch $200 or more.

Michter’s 20 year old

Michter’s 20 is always a good bet for sellers, particularly if they bought it at close to retail ($1,200). “Secondary is down to $3,000, which is still great,” says Kenny, “and this won’t dip too much further.”

Penelope

Many editions are moving, include Crème Brûlée, 17 year old American light whiskey, Rio, and Havana, most under $200 per bottle.

Russell’s Reserve 15 year old

Wild Turkey claims it will not release this again, thus sending demand for this bottling through the roof. Bottles are moving for $550.

William Larue Weller

Saraff recently completed an entire vertical of all 24 bottles of William Larue Weller ever made for a client. The bottle remains undeniably hot, always moving for more than $1,000.